SIGNIFICANT RISK TRANSFER

SUBCLASSES

- Cyber

- Financial

- Nuclear

- Personal Accident

- Political Violence

- Miscellaneous

TARGET CLIENTS

- Regulated banks who are seeking to reduce risk

weighted assets (RWA) & therefore regulatory capital

using the Capital Requirements Regulation (CRR)

SRT methodology / Basel capital rules.

APPETITE

- Any jurisdiction around the world but main focus is UK

& Europe - Any underlying asset class provided there is some

granularity. Auto, Consumer, Mortgage, Real Estate,

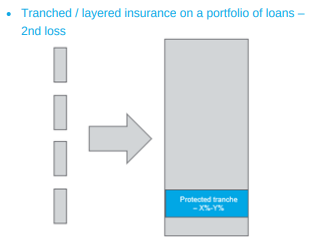

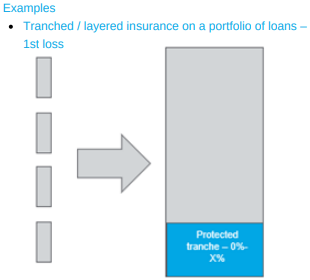

SME Loans, Corporate Loans etc… - 1st loss, XS of expected loss, mezzanine protection

or other - Replenishment features are OK

COVER

- Insurance or guarantee of the credit default risk on a 1st

or mezzanine tranche of a portfolio of assets

CAPABILITIES

- Normal Max Line Size EUR 200m but could be higher

- Normal Max Tenor ~10 years but could be longer

- Insurance or guarantee form